Global AI Pitch Summit 2025

Table of Content

Day 1

The Future of AI and Machine Learning: What's the Next Big Investment Opportunity

Fueling Language Intelligence: Why Data is the Engine of LLM training

DBC AI Public Chain: The Trillion-Dollar Infrastructure for Decentralized AI

Day 2

Agent Infrastructure: Empowering the Next Generation of Autonomy and Innovation

Demystifying AI Startup Fundraising: Valuation Trends Funding Insights and Founders Ownership

From Sparks to Limits: The Evolution of ChatGPT and the Bottleneck of LLMs

The State of Venture Capital 2025: Venture Capital Investment in AI startups

The Future We Lead: Harnessing AI for a Better World

Steve Adler (Former Mayor of Austin)

Steve Adler, former Mayor of Austin, Texas, delivered a compelling keynote that focused on the intersection of technology, governance, and societal impact. Drawing from his experience in public service, Adler emphasized that we are not merely witnesses to technological advancement but active architects of our shared future. He identified this moment as the most exciting time to start a company since the iPhone's creation, citing the convergence of abundant capital, enhanced capabilities, and a disruptive technological shift in AI. Adler notably remarked that "the greatest financial opportunities are born of the greatest volatilities," encouraging investors to view market uncertainty as an opportunity rather than a deterrent.

Leading the Change - Next FANG

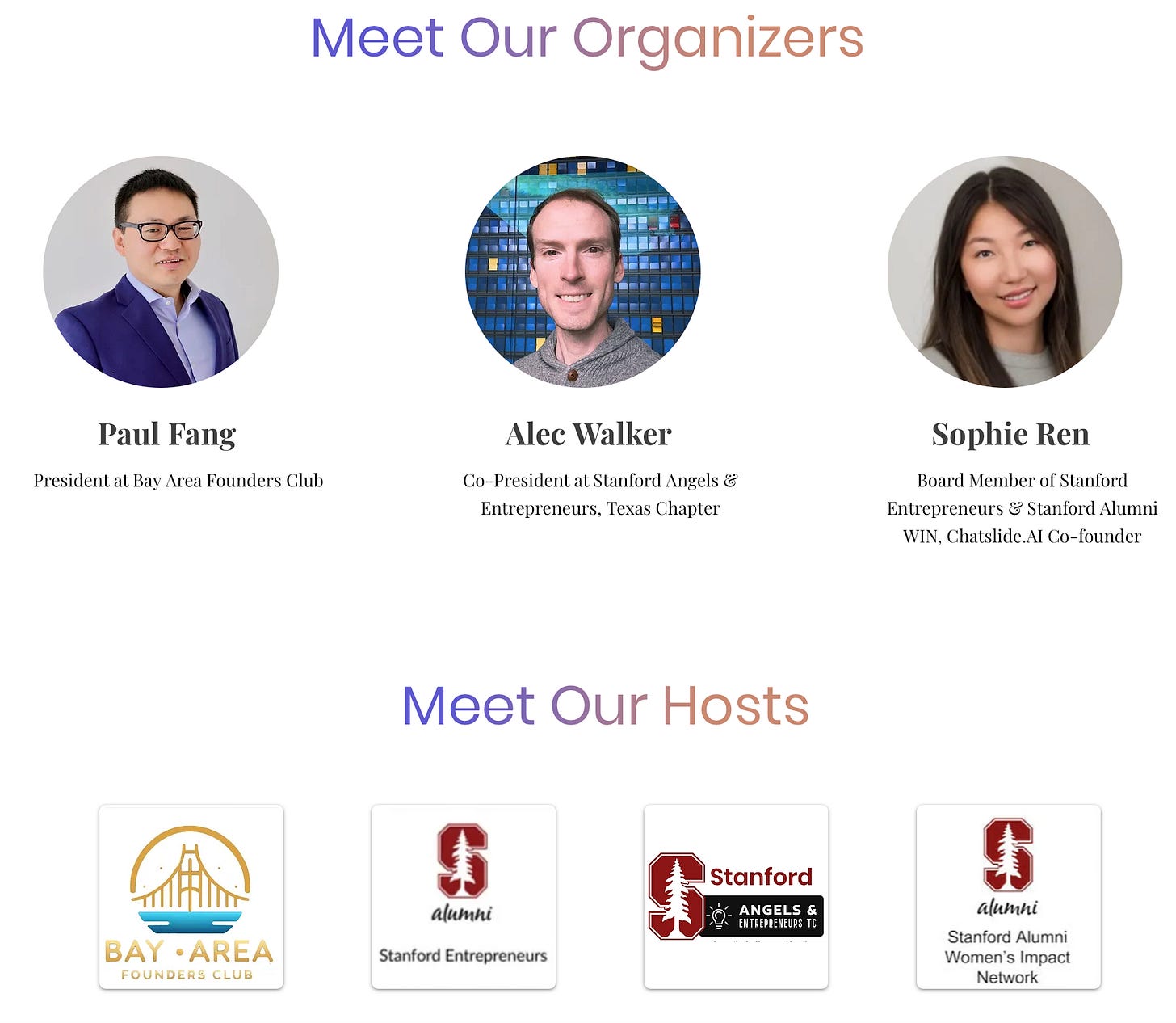

Paul Fang (Bay Area Founders Club), Alec Walker (Stanford Angels & Entrepreneurs), Sophie Ren (Stanford Entrepreneurs)

Paul Fang, founder and president of the Bay Area Founders Club (BFC), opened the session by outlining the organization’s mission to empower young entrepreneurs and innovators. Highlighting the group’s remarkable growth trajectory, he noted its expansion to over 30,000 members, including 1,000+ startups, 350+ venture capital firms, and a network of industry leaders. Fang underscored the value of fostering communities that transcend transactional relationships, sharing how the club curates specialized events ranging from Stanford alumni networking sessions and golf retreats to intimate AI-focused dinner discussions. He also unveiled the BFC’s social platform, designed to streamline meaningful connections between founders and investors.

Alec Walker, co-president of Stanford Angels & Entrepreneurs, delivered a thought-provoking analysis of the AI sector’s evolving dynamics. Addressing the cyclical nature of public enthusiasm for AI advancements, he explored the hurdles startups face in differentiating themselves amid increasingly commoditized foundational models. Walker advocated for building “buoyant” businesses—agile ventures capable of adapting to rapid improvements in AI performance. He also urged founders to develop deep empathy for niche markets, arguing that vertical-specific problem-solving will define the next generation of AI-driven innovation.

Sophie REN, board member of Stanford Entrepreneurs and Stanford Alumni WIN, and co-founder of ChatSlide.AI, offered insights into harnessing unstructured data for AI applications. Ren shared her fascination with unlocking human potential through AI, exemplified by her work on a data-driven gamification platform that personalizes user engagement. Closing her remarks, she challenged attendees to prioritize ethical considerations and long-term societal impact when architecting AI systems, stating, “True innovation isn’t just about brilliance—it’s about building tools that endure and elevate.

The Investment Horizon: Emerging Trends in AI

James da Costa (Andreessen Horowitz), Komal Vij (Stanford University)

In a compelling fireside chat moderated by Komal Vij, James da Costa, Partner at a16z, highlighted how AI is either augmenting or replacing traditional roles while creating new opportunities previously inaccessible to software solutions. Da Costa emphasized the revolutionary impact of multimodal AI, particularly in voice-driven solutions, citing HappyRobot's success in transforming freight load scheduling through AI automation. He also discussed AI's significant role in financial services, where it's generating billions in savings through enhanced fraud detection and compliance measures.

Future of AI and Machine Learning: Next Big Investment Opportunity

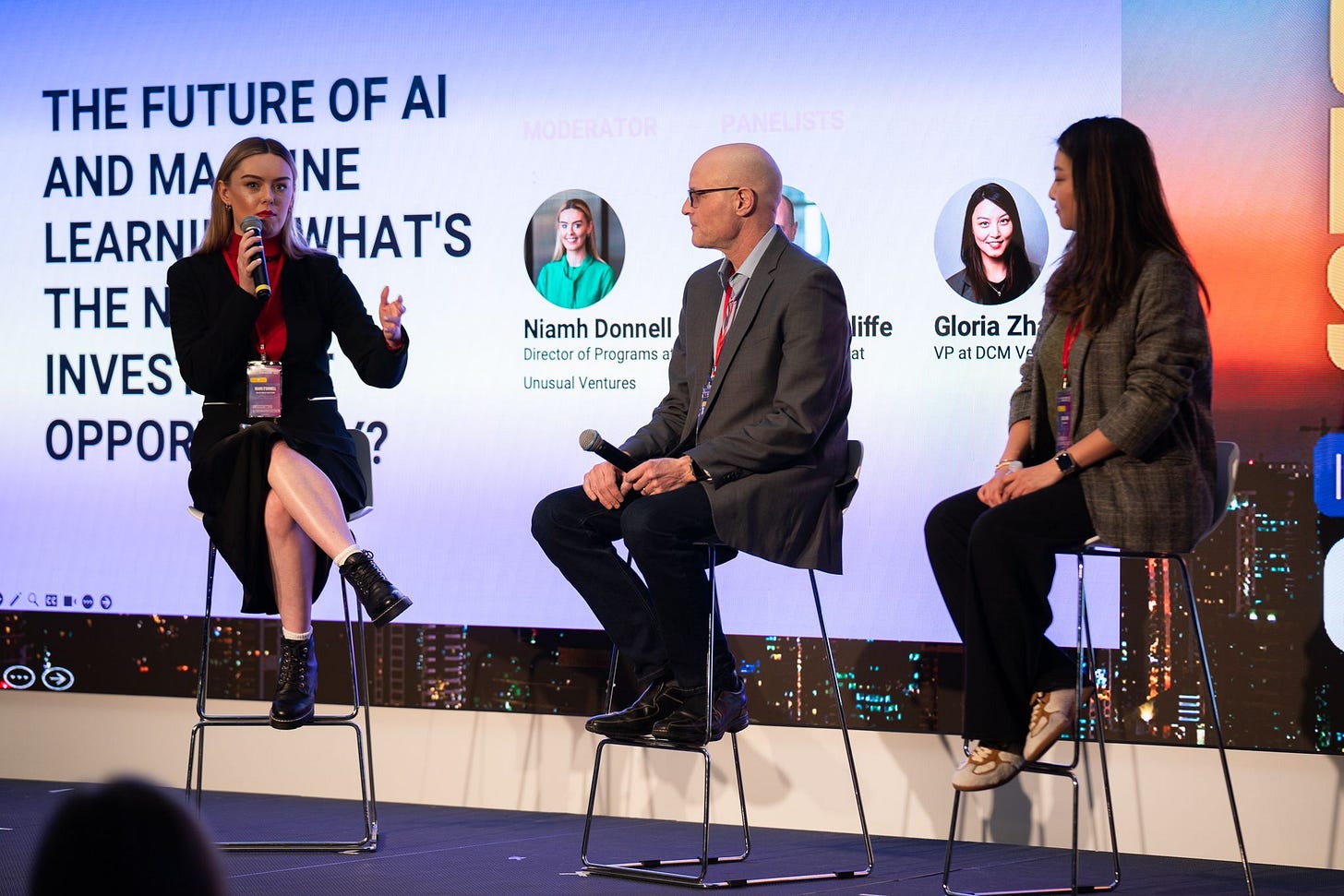

Ronald Ratcliffe (BlackRock), Gloria Zhang (DCM Ventures), Niamh O'Donnell (Unusual Ventures)

This panel discussion, moderated by Niamh O'Donnell, explored the evolving AI landscape and investment opportunities. O'Donnell emphasized AI's growing impact across industries and the critical need for high-quality data and annotation, highlighting Unusual Ventures' portfolio company, HumanSignal.

Ronald Ratcliffe described AI as a "Megaforce" shaping global markets, emphasizing the importance of responsible AI implementation with proper oversight. He discussed how BlackRock is standardizing access to advanced financial models through AI integration.

Gloria Zhang outlined emerging trends, including world models integrating real-world physics, multimodal AI for autonomous systems, and AI-driven disruptions in SaaS and gaming. She stressed the importance of strategic investments in capitalizing on these developments.

Bots with Wallets

Miko Matsumura (Gumi Cryptos Capital)

Miko Matsumura, Managing Partner at Gumi Cryptos Capital, delivered a fascinating keynote on the concept of "bots with wallets" - AI entities with economic agency. He drew compelling parallels between biological organisms and these new digital entities, comparing their emergence to major milestones in Earth's history. Matsumura predicted that while many crypto projects might fail, successful ones could give rise to a new form of artificial life, presenting a future where digital and biological life forms coexist and co-evolve.

Fueling Language Intelligence: Why Data Is the Engine of LLM Training

Steven Feng (Stanford University)

Steven Feng, Co-instructor for Stanford University's CS25 Transformers Course, provided valuable insight into the fundamental role of data in developing large language models. He presented fascinating research comparing human language learning with LLM training, noting that while children process around 100 million words by age 13, LLMs require trillions of tokens. Feng's work with NVIDIA revealed a more efficient two-phase LLM pre-training approach: using diverse data initially for broad understanding, followed by high-quality, domain-specific data for refinement. This method outperforms traditional single-phase training, emphasizing the importance of structured, high-quality data in AI development.

Fastest Way to Eye-Catching Video Promptlessly on Mobile

Ella Zhang, CEO of Creati AI and former engineer at Google and Apple, introduced revolutionary approaches to AI-powered content creation. She showcased Creati AI's mobile app, which enables users to create viral-worthy videos without complex prompt engineering. A key innovation was their element consistency technology, ensuring stable character and product representation throughout AI-generated videos. The app's success is evident in its impressive metrics: over 5 million downloads in six months and a top 10 ranking in the U.S. iOS App Store.

DBC AI Public Chain: The Trillion-Dollar Infrastructure for Decentralized AI

Terry Roston (DeepBrain Chain)

Terry Roston, Council Director at DeepBrain Chain, presented a vision for decentralized AI infrastructure. He explained how DBC is standardizing access to AI resources through blockchain technology and distributed computing, making them more affordable, secure, and widely available. Roston emphasized that this decentralized approach could unlock tremendous value, potentially reaching into the trillions of dollars as it reshapes the AI landscape.

AI for Good – Startup Innovation

Nabila Elassar (Impact Genius) & Ahmad Rushdi (Stanford HAI)

This fireside chat brought together Nabila Elassar, Founder of Impact Genius and Director at the AI for Good Institute, with Ahmad Rushdi, Research Manager at Stanford Institute for Human-Centered Artificial Intelligence. They discussed how startups can leverage AI for both business success and social impact, emphasizing the importance of integrating ethical AI practices and human-centered design from the outset. The conversation centered on how AI innovation can advance the United Nations Sustainable Development Goals while maintaining strong ethical standards and user-centric solutions.

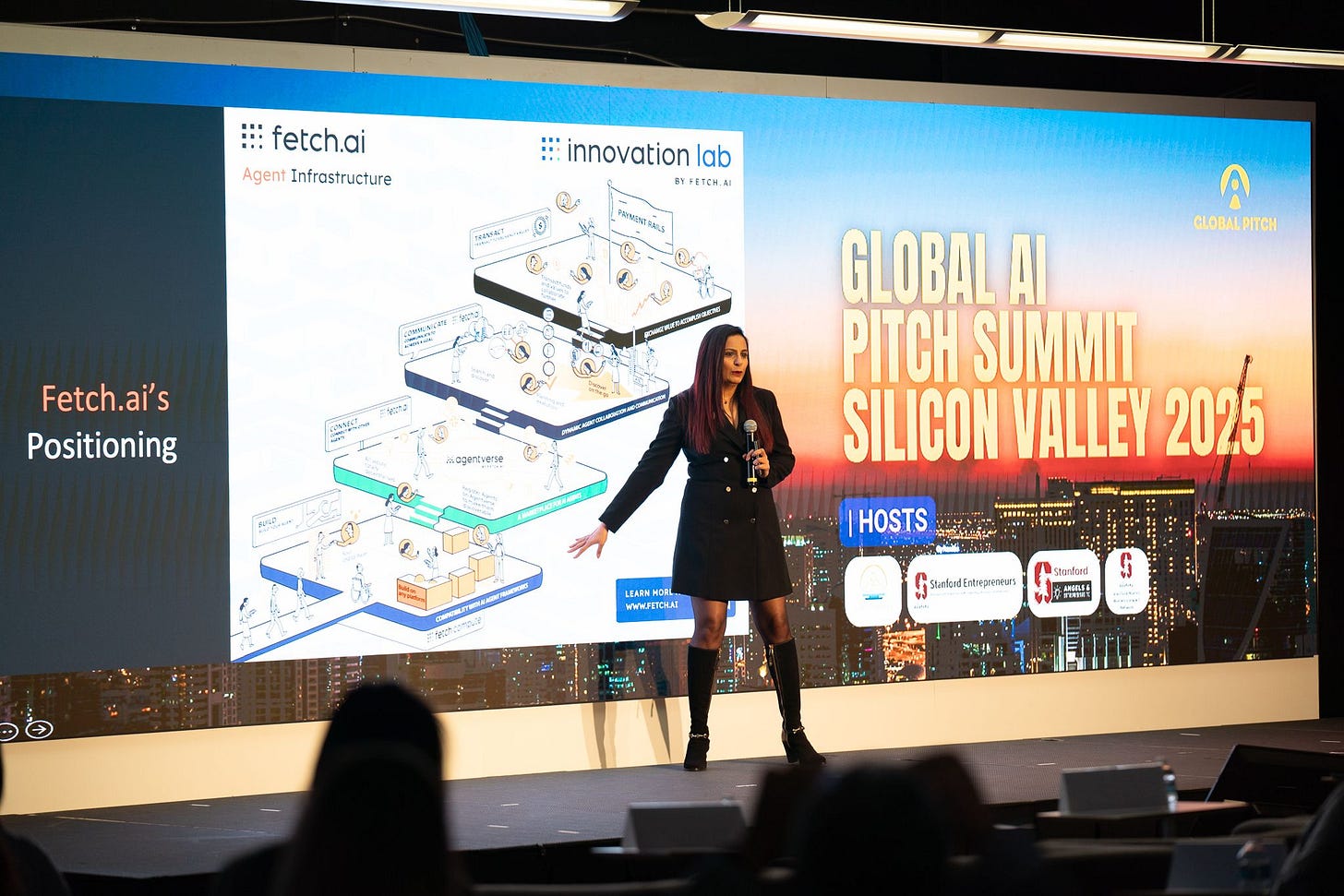

Agent Infrastructure: Empowering the Next Generation of Autonomy and Innovation

Sana Wajid, Chief Development Officer at Fetch.ai and Fetch.ai Innovation Lab, delivered a compelling keynote on the future of AI autonomy. She introduced Agentverse, a marketplace designed to be the "Google" for AI agents, enabling developers to monetize their AI agents while allowing businesses to integrate AI solutions without heavy in-house development. Wajid also highlighted Fetch.ai's commitment to AI-driven entrepreneurship through its Innovation Lab, which provides funding, computing power, and infrastructure support for early-stage startups.

Bridging Web2 & Web3 Through AI

Tess Hau (Tess Ventures) & Michael Terpin (Transform Ventures)

This panel discussion explored how AI is bridging the gap between traditional Web2 platforms and the emerging Web3 ecosystem. The speakers emphasized AI's role in transitioning from centralized models to decentralized, ownership-driven paradigms. They discussed the emergence of autonomous AI agents capable of performing complex tasks independently, the importance of data sovereignty in tokenized economies, and the potential for decentralized AI networks to democratize AI power. The insights shared by Tess Hau and Michael Terpin at the summit offer a compelling roadmap for navigating this transformative era.

The Challenge of Adopting AI in Enterprises

David Hefter, AI Champion for Investments at BlackRock, addressed the complexities of AI adoption in large organizations. He noted that despite significant interest, many enterprises are still in the early adoption stages, facing challenges related to data sensitivity, security concerns, and legacy system integration. Hefter highlighted successful AI use cases in enterprises, including meeting summaries, customer support automation, and AI-assisted software development, while predicting that 2025 would focus on AI agents, though widespread adoption would take time.

AI Startup Fundraising and Valuations

Drawing from data across over 50,000 startup cap tables, Peter Walker, Head of Insights at Carta, provided a comprehensive analysis of AI startup fundraising trends. He noted that while AI valuations are approaching 2021 peaks, investors have become more selective. Walker emphasized the importance of technical differentiation, scalability, and defensibility in AI startups, noting that simply incorporating AI is no longer sufficient for success.

From Sparks to Limits: The Evolution of ChatGPT and the Bottleneck of LLMs

Jenny Xiao (Leonis Capital, Ex-OpenAI)

Jenny Xiao, Partner at Leonis Capital and former OpenAI researcher, delivered an insightful analysis of AI's trajectory and infrastructure demands. She compared AI enterprises to industrial projects like Tesla's Gigafactories, noting that training GPT-4 required 25,000 GPUs and significant energy consumption. Xiao outlined three strategic pathways for addressing scaling challenges: infrastructure expansion, architectural innovation beyond Transformer models, and hybrid public-private partnerships.

Identifying and Investing in AI-Native Startups

John Whaley (Inception Studio)

John Whaley, founder of Inception Studio and Stanford Lecturer, provided valuable insights into AI investment strategies. He emphasized that successful AI-native startups integrate AI into their core business model rather than treating it as a feature. Whaley noted that with AI spending projected to exceed $3 trillion between 2023 and 2027, investors must look beyond superficial implementations to find companies truly leveraging AI as their foundation.

Traits of International Startup Ecosystems and AI Adoption

Rutvik Deepak, co-founder of Go Ventures, provided a global perspective on AI adoption and entrepreneurship trends. He highlighted success stories from unexpected markets, including Indian and Singaporean startups that outperformed their Silicon Valley counterparts. Deepak analyzed distinct geographic patterns in AI adoption, noting how different regions prioritize various aspects of AI implementation based on local needs and regulatory frameworks.

AI + Education – Preparing Our Kids for an AI World

Jun Liu, founder of 7EDU Impact Academy, addressed the critical need to adapt education for an AI-driven future. She identified a disconnect between AI's rapid industry adoption and education's cautious approach, advocating for responsible AI integration in classrooms through adaptive testing and real-time feedback. Liu emphasized the importance of cultivating critical thinking and creative problem-solving skills that complement rather than compete with AI capabilities.

How to Get Involved in the Silicon Valley Startup Ecosystem

Asror Arabjanov (Silkroad Innovation Hub), Patricia Liu (MIT Angel), Nabila Elassar (Stanford Entrepreneurs), Alec Walker (Stanford Angels & Entrepreneurs), Mariane Bekker (Founders Bay), and Aishwarya Srinivasan (LinkedIn Top Voice).

Asror Arabjanov, Co-founder of Silkroad Innovation Hub and Stanford GSB MBA, discussed creating a welcoming community for founders from Central Eurasia. His organization offers a space in Palo Alto for entrepreneurs and investors, fostering connections and growth within this niche ecosystem.

Patricia Liu, a Startup Advisor at MIT Angel, highlighted her work in curating deal flow for investors and supporting entrepreneurs. She emphasized MIT Angels' focus on deep science and tech startups, offering not just funding but also valuable connections and mentorship.

Nabila Elassar, Founder of Impact Genius and Board Member at Stanford Entrepreneurs, shared her passion for promoting AI for good. She detailed the AI for Good Institute's bootcamp for aspiring entrepreneurs, which covers technical development, business innovation, and ethical AI practices.

Alec Walker, President of Stanford Angels & Entrepreneurs, explained how his organization connects startups with investors and resources. He emphasized their volunteer-run model and their commitment to fostering the entrepreneurial ecosystem without taking equity.

Mariane Bekker, Investor and Managing Partner at Founders Bay, spoke about building a community of 30,000 founders and VCs. She shared valuable insights on leveraging social media and events to grow a startup ecosystem and promote diversity in tech.

Aishwarya Srinivasan, Head of AI Developer Relations at Fireworks AI, discussed her journey from data scientist to community builder. She highlighted her work in responsible AI and her current role in supporting startups with AI infrastructure through Fireworks AI's pilot program.

Legal Considerations for AI Startups

Lindsey Mignano, Co-Chair of the Stanford Alumni Association Women's Impact Network, discussed the evolving venture capital landscape in AI. She highlighted investors' preference for AI-native startups and outlined key factors for success, including unique technology, scalability, and market impact. She emphasized that winning AI startups truly understand both the tech and the industry problems they aim to solve. Mignano also stressed the importance of a strong founding team. Investors favor teams with a blend of AI expertise, domain knowledge, and business acumen. This mix is essential for building and scaling an AI-driven company. Her final advice? Focus on real value, not AI hype. The best AI startups solve real problems in new and innovative ways.

VC Mindset: Funding Strategies for Future AI Titans

Ilya Strebulaev (Stanford GSB) & Alex Dang (McKinsey & Company)

The summit concluded with insights from Stanford GSB professor Ilya Strebulaev and McKinsey senior advisor Alex Dang on venture capital principles in the AI era. They compared AI's transformative impact to historical technological shifts and discussed the venture mindset, where VCs expect most investments to fail, but a few successes can generate 100x returns. They also discussed the importance of due diligence, emphasizing that founders should be strategic in selecting investors, understanding their risk appetite, and the stage in the investment cycle. The best VCs don’t require consensus; conviction from a single partner can be the key to securing investment. The speakers emphasized the importance of team dynamics and adaptability in AI startups, noting that 46% of new unicorns in 2024 were AI-driven.

Conclusion

The Global AI Pitch Summit 2025 provided an unprecedented platform for knowledge sharing and networking in the AI ecosystem. Through diverse perspectives from investors, entrepreneurs, academics, and industry leaders, the event highlighted the transformative potential of AI across industries while addressing critical challenges in implementation, scaling, and ethical considerations. As we move forward, the insights shared at this summit will continue to shape the trajectory of AI innovation and investment in Silicon Valley and beyond.

About The Bay Area Founders Club

The Bay Area Founders Club (BFC), founded by Dr. Paul Fang in Silicon Valley in 2022 and managed by a dedicated group of Stanford alumni and students, is a thriving community of over 30,000 members, including more than 1000 startups and over 350 venture capital firms. With most startups in our network raising $1-10 million, and some exceeding $20 million, our mission is to empower creators who aspire to make a global impact. We provide the essential resources, support, and connections needed to transform visionary ideas into reality.

Subscribe to our LinkedIn , Youtube, Substack, Website, Luma, Twitter to stay updated!

Upgrade to BFC Premium Membership TODAY

What You Get:

✅ Spotlight Your Brand: Get your event or product featured in our top-tier Substack newsletter, which reaches over 30,000 subscribers, including 1,000+ startups and 350+ VCs, with more than 2 million annual views

✅ Exclusive Access: Join private BFC groups filled with top-tier founders, VCs, and game-changers

✅ VIP Invitations: Attend premium, members-only networking events across Silicon Valley

✅ Become a BFC Founding Member: Support Paul’s bold 10-year vision to build 200 global chapters. Your membership includes a 10-year access—and a front-row seat as BFC becomes as iconic as KFC.

Why Join?

This isn’t just another membership — it’s your front-row seat to Silicon Valley’s most influential founder-investor network. Whether you’re scaling your startup or building your brand, BFC Premium puts you in the room where it happens.

👉 Become a Member Today — and Build What Matters.